House or apartment? City or country? The big things to consider when buying a first home

The Conversation | October 1, 2025

Buying a first home is one of the biggest financial decisions a person can make. When there are so many questions to consider, it can be hard to know where to begin.

Where should I be looking to buy? Should I buy a house, or an apartment? And should it be an established home, an apartment off the plan, or a new build?

The answers to these and other relevant questions will be different for everyone – there’s no one-size-fits-all answer.

That said, academic research can still help to unpack some of the key things for first home buyers to consider when choosing where and what kind of property they’d like to buy.

Location, location, location

For a prospective home buyer, choosing where to buy is a major decision. It is the primary consideration for how much a property costs, and the nearness of family, friends, work and transport.

Social factors – such as a neighbourhood’s education and income levels, and its crime rates – can make a place more or less attractive. Homes are also investments, so buyers often think about whether prices will go up in the future.

People’s preferences and local conditions strongly influence buying decisions. Using advanced modelling, my previous research has shown house prices across Greater Sydney respond to different factors differently depending on location. Access to good public transport, for example, will have a bigger impact in some areas than others.

Broadly speaking, locations can be classed as urban (city), semi-rural, or rural (country). Homes across these categories will differ not only in terms of their typical price and size, but also a range of other important factors.

For example, country homes may offer space and quiet but less infrastructure. Cities have more jobs but are expensive. Suburbs are a middle ground with bigger homes at lower prices but longer commutes.

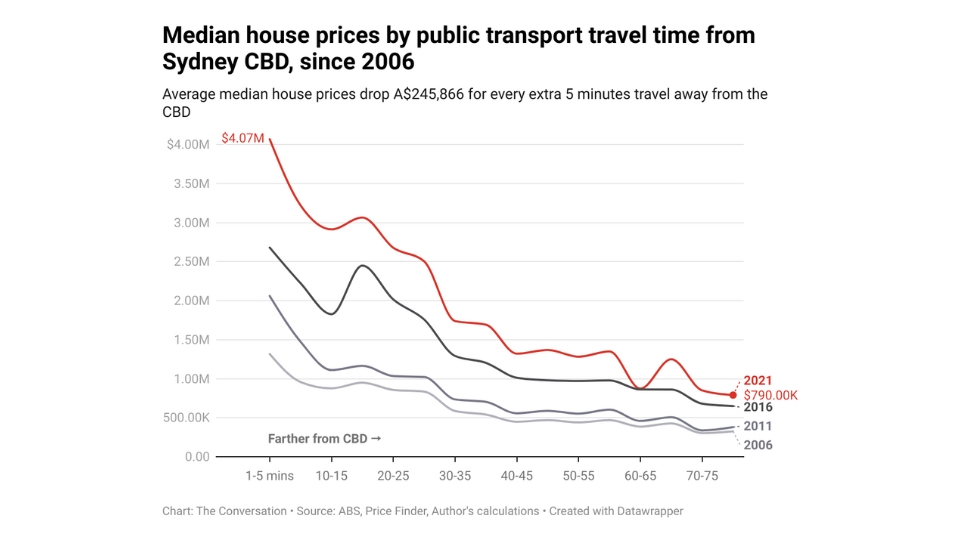

Distance to key places – such as the city centre, schools, shopping, and parks – matters. My analysis, using 15 years of Sydney house price data from 2006 to 2021, shows how median house prices decrease for every five minutes of extra travel time to the city.

The answer to where the “right” location is depends on what a buyer values most: lifestyle, affordability, or future investment.

Median house prices by public transport travel time from Sydney CBD, since 2006. Image: The Conversation.

House or apartment?

Related to the decision of where to buy is another big question – what type of property. Two of the main types to choose from are houses and apartments (though some may opt for something in between, such as a townhouse). Both have pros and cons.

Houses offer more space, privacy, and the chance for land value to grow, making them ideal for families or people planning to stay long-term. They may provide an opportunity for renovations or extensions. Houses may offer higher long-term growth because land is scarce.

The flipside is they usually cost more, may be further from work or school than an apartment and may need more maintenance.

Apartments or units are generally cheaper, easier to look after, and often close to transport, jobs and shops. Some apartments also have shared facilities such as gyms or pools.

However, they are smaller, give less privacy, and may not increase in value as much as houses. Apartment owners usually also have to pay ongoing strata fees, typically calculated as a percentage of a property’s value.

Making this choice will depend on a prospective buyer’s life stage, lifestyle, and budget. Families often prefer houses for space, while younger buyers may like apartments for convenience and low maintenance.

Some first-time home buyers might see buying an apartment as one way to “get a foot on the property ladder”. But it’s important to remember upgrading to a house later could mean paying transaction fees like stamp duty twice (although many states, including Victoria and New South Wales, offer stamp duty concessions and exemptions for first home buyers).

Buy existing, or build?

The decision to buy or build depends on a combination of financial, lifestyle, and location considerations. Building a new home, including knock-down rebuilds or off-the-plan apartments, appeals to buyers seeking modern design, energy efficiency and customisation.

Off-the-plan purchases (where you buy a planned house or apartment before the building is completed) allow buyers to select layouts and finishes. Knock-down rebuilds enable homeowners to remain in established neighbourhoods yet replace older dwellings with contemporary, higher-value homes.

However, building carries financial and timing risks. Construction delays, unforeseen site issues, and regulatory approvals can extend timelines and increase costs. This can make building a less suitable option for buyers who need immediate housing or have limited budgets.

Off-the-plan apartments are often located in high-demand areas, offering potential capital growth. But buyers take on the market risk if property values decline before completion.

Building or buying off-the-plan is typically less appropriate for buyers seeking certainty, speed or minimal risk exposure.

In contrast, buying an existing house provides certainty of location, move-in readiness and mature neighbourhood infrastructure. But it may mean a greater need for renovations and maintenance, and limit design flexibility.

This article was written by Xin Janet Ge, Associate Professor, School of Built Environment, University of Technology Sydney.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

The author would like to acknowledge the contribution of Dr Jinson Zhang at the University of Technology Sydney for research assistance in the preparation of this article.

Disclaimer: This article provides general information only and does not take into account your personal objectives, financial situation, or needs. It is not intended as financial advice. All investments carry risk.

Sponsored

We have a request

SHE DEFINED’s journalism is independent and we’re committed to elevating the voices of women by putting them front-and-centre in our stories and giving them a platform to speak up.

Quality journalism and editorial content takes time, money and resources to create, which is why your support matters. We don’t have a paywall or exclusive subscriptions because we believe in keeping our stories open to everyone.

Help support our mission by making a financial contribution today.

The Conversation

The Conversation Australia and New Zealand is a unique collaboration between academics and journalists that in just 10 years has become the world’s leading publisher of research-based news and analysis.

The Conversation Australia and New Zealand was founded in Melbourne in 2011. It now operates as a global network of sister sites with dedicated teams working in Indonesia, Spain, the UK, US, France, Africa, and Canada.